This meme stock hit an ATH of just over 33 in mid-February. Big Short investor Danny Moses says meme stocks remind him of the dot-com bubble slams the Fed and calls out Archegos and Greensill in a new interview.

Top 3 Meme Stocks To Pay Attention To This Week Meme Stock Maven

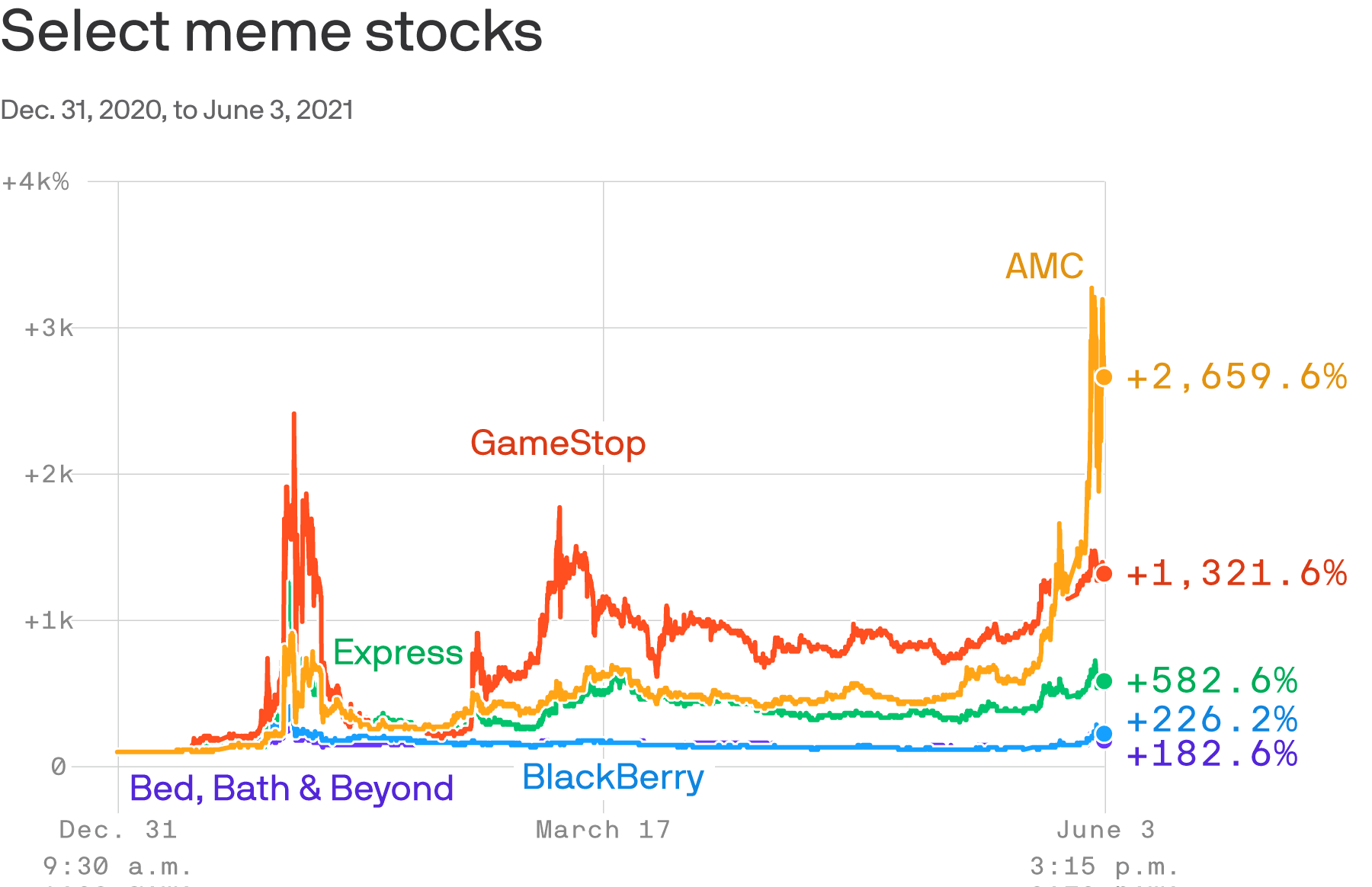

Dan Niles of Satori Fund said stocks like AMC and GameStop could rally more but he warned the fun would come to an end when the Feds tapering begins.

Meme stocks dangerous. Imagining that its patents are worth something or that it is lined up to hook up with Apple to develop its self-driving car is worse than speculation its artificial pumping of a failed startup. My Low-Risk High-Profit Meme Stock. 15 KOSS stock closed the trading day at.

The stock can become detached from its fundamentals. Crypto and meme stocks are more memorable to young investors than traditional companies Turley says. Selling overpriced stockstock that you know is overpriced that everyone knows is overpricedis not in itself securities fraud.

Shot on iPhone Shorts FailArmy Drone. Third many meme stock investors are new to investing. The biggest danger of meme stocks is that due to a huge influx of investors who dont care about the companys performance and its fundamentals the stock price can become detached from its.

These stocks move at the whim and fancy of a largely inexperienced community. LFMD stock currently hovers just below 11. If playback doesnt begin shortly try restarting your device.

Milwaukee Wisconsin-based Koss which designs and manufactures headphones has had a wilder ride than most meme stocks this year. These moves are major short squ. However thats still up 64 YTD.

I have read on social media of cases where young investors placed all of their life savings into these meme stocks and lost everything. By dangerous you mean highly profitable then yes meme stocks are straight lethal. Gamestop is one of the best examples of this as the stock.

A meme stock spins stories that simply arent true to justify somehow the stocks price increase. The primary reason meme stocks dominate the financial news headlines is that they jump dramatically in price over a short period of time. Young investors care far less about the bottom line of a corporation and far more about a meme or narrative they can collectively share with their friends.

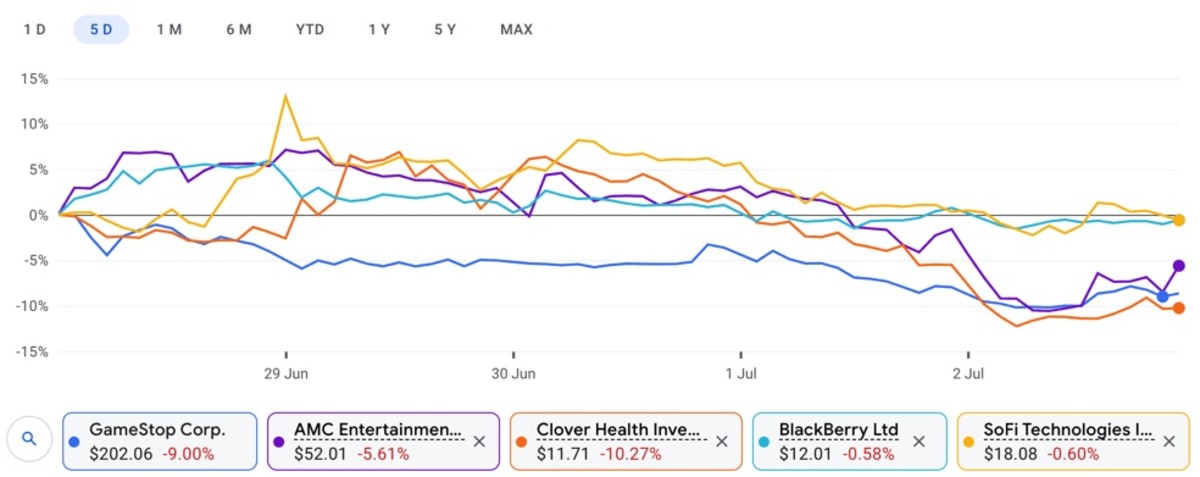

Here are the 16 best quotes. Hey guys Matt here I am releasing this video to explain why GME and AMC and other meme stocks are having a little fallout. Published Fri Jun 4 2021154 PM EDT Updated Fri Jun 4 2021247 PM EDT.

05Jun2021 Investment 0 comments. Every social media outlet out there was trending these meme stocks such as Gamestop AMC and as a result flooded the market with millions of newbie investors. Therefore they are prime candidates to make classic mistakes like capitulating selling out at the bottom.

Originally published at CNBC. There is always a limited-risk way to grab easy profits with options. Volatility is not always a good thing for stock traders but it most certainly is for options traders.

It has since lost around two-thirds of its value. It just makes people nervous. Investor Dan Niles says Fed tapering could make meme stocks dangerous on the downside.

To say that meme stocks are volatile is an understatement. Investor Dan Niles says Fed tapering could make meme stocks dangerous on the downside.

The Money Fight Meme Stocks The Short Squeeze And The Sharp Play

Top 3 Meme Stocks To Pay Attention To This Week Meme Stock Maven

Meme Stocks Turn Boring Financial Times World News Curatory

This Is Extremely Dangerous To The Stock Market Meme Finance Memes Tips Photos Videos

What Is Going On With Gamestop Meme Stocks Explained

Amc The New No 1 Meme Stock Axios